The Indian mutual fund landscape is vast, but few funds have built as solid a reputation as the SBI Equity Hybrid Fund (MUTF_IN: SBI_EQUI_HYBR_VUWAZQ). This aggressive hybrid fund from SBI Mutual Fund is designed for investors seeking a balanced approach—combining the growth potential of equities with the relative stability of debt instruments. In this article, we’ll explore every aspect of the SBI Equity Hybrid Fund, from its investment strategy and performance to its portfolio composition, tax implications, and suitability for different types of investors. Whether you’re a new investor or a seasoned market participant, this guide will help you understand if this fund aligns with your financial goals.

What is SBI Equity Hybrid Fund (MUTF_IN: SBI_EQUI_HYBR_VUWAZQ)?

The SBI Equity Hybrid Fund is an aggressive hybrid mutual fund, meaning it invests a significant portion of its assets in equities (stocks) and the rest in debt instruments (bonds, government securities, etc.). The fund’s objective is to provide long-term capital appreciation along with liquidity by investing in a mix of equity and debt.

-

Launch Date: January 19, 2005

-

Fund Category: Aggressive Hybrid Fund

-

Risk Level: Very High

-

Minimum Investment: SIP ₹100, Lump Sum ₹1,000

-

Exit Load: 1% if redeemed within 365 days

-

No Lock-in Period: Open-ended scheme

Investment Strategy and Asset Allocation

Equity Allocation:

The fund typically maintains around 65-75% of its portfolio in equities, with a strong bias towards large-cap stocks. The remaining equity exposure is allocated to mid-cap companies, providing a balance between growth and stability.

Debt Allocation:

About 20-30% of the portfolio is invested in debt and money market instruments, including government securities, corporate bonds, and other fixed-income assets. This helps reduce volatility and provides a cushion during market downturns.

Other Holdings:

A small portion (around 3-6%) is kept in cash, cash equivalents, and other instruments like InvITs (Infrastructure Investment Trusts) and REITs (Real Estate Investment Trusts).

Portfolio Composition

Top Equity Holdings (as of June 2025):

| Stock Name | Sector | % of Portfolio |

|---|---|---|

| HDFC Bank Ltd. | Private Sector Bank | 5.98% |

| Solar Industries India Ltd. | Explosives | 4.45% |

| ICICI Bank Ltd. | Private Sector Bank | 4.43% |

| Bharti Airtel Ltd. | Telecom | 4.28% |

| Divis Laboratories Ltd. | Pharmaceuticals | 3.41% |

| State Bank of India | Public Sector Bank | 3.20% |

| Shree Cement Ltd. | Cement | 3.09% |

| MRF Ltd. | Tyres & Rubber Products | 3.09% |

| Infosys Ltd. | IT/Software | 3.04% |

| Bajaj Finance Ltd. | NBFC | 2.92% |

Top Debt Holdings:

-

Government of India Securities (e.g., 6.79% GOI 2034): 5.32%

-

LIC Housing Finance NCD: 1.27%

-

Adani Airport Holdings Debenture: 1.15%

Asset Allocation (approximate):

-

Equity: 70%

-

Debt: 26%

-

Others (Cash, InvITs, REITs): 4%

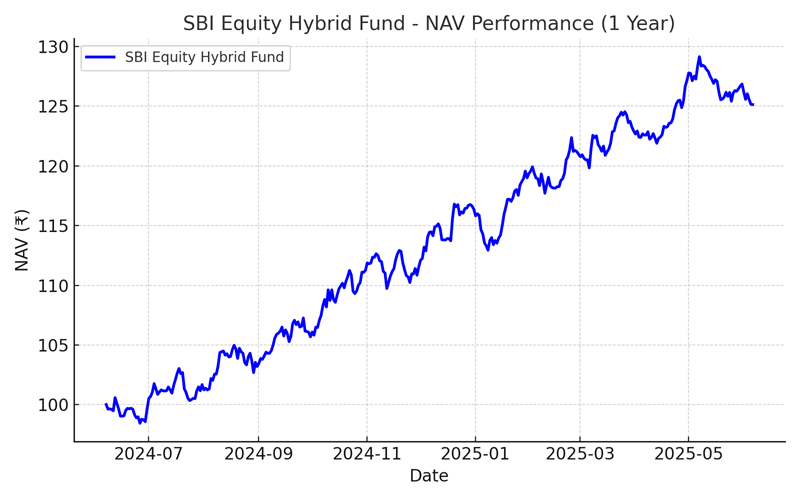

Performance Overview

The SBI Equity Hybrid Fund has demonstrated robust performance over various timeframes, consistently ranking among the top aggressive hybrid funds in India.

Returns Snapshot (as of June 2025):

| Period | Absolute Returns | Annualised Returns | Category Rank |

|---|---|---|---|

| 1 Year | 16.98% | 16.98% | 3/30 |

| 3 Years | 52.21% | 15.00% | 18/30 |

| 5 Years | 130.47% | 18.16% | 18/28 |

| 10 Years | 220.90% | 12.36% | 9/19 |

| Since Inception | 1634.30% | 15.02% | 8/29 |

SIP Returns:

A monthly SIP over 10 years would have doubled your investment, with an annualised return of 13.43%.

Consistency:

The fund has consistently performed in the top two quartiles among aggressive hybrid funds over the last five years, making it a reliable choice for long-term investors.

Expense Ratio and Fund Size

-

Expense Ratio: 1.4% (as of June 2025), which is competitive within its category.

-

Assets Under Management (AUM): ₹74,035.66 Crore, making it one of the largest funds in its segment.

Taxation

-

Short-Term Capital Gains (STCG): 20% if redeemed within 1 year.

-

Long-Term Capital Gains (LTCG): 12.5% on gains above ₹1.25 lakh in a financial year if held for more than 1 year.

-

Dividend Taxation: Dividends are taxed as per the investor’s income tax slab.

Who Should Invest?

The SBI Equity Hybrid Fund is suitable for:

-

Moderate to Aggressive Investors: Those seeking higher returns than pure debt funds but with lower volatility than pure equity funds.

-

Long-Term Goals: Ideal for goals with a 5-year or longer horizon, such as children’s education, retirement, or wealth creation.

-

First-Time Equity Investors: The fund offers a balanced route to equity markets with some downside protection through debt allocation.

Investment Modes

You can invest in SBI Equity Hybrid Fund through:

-

SIP (Systematic Investment Plan): Start with as little as ₹100 per month.

-

Lump Sum: Minimum investment of ₹1,000.

-

Direct or Regular Plan: Direct plans have a lower expense ratio, while regular plans offer distributor support.

-

Online or Offline: Invest via the SBI Mutual Fund website, third-party platforms, or through banks and distributors.

Advantages of SBI Equity Hybrid Fund

-

Diversification: Exposure to both equity and debt reduces risk and smoothens returns.

-

Strong Track Record: Consistent performance over long periods.

-

Large-Cap Focus: Majority of equity portfolio in stable, blue-chip companies.

-

Flexibility: No lock-in period; suitable for both SIP and lump sum investments.

-

Liquidity: Open-ended structure allows easy entry and exit.

Risks and Considerations

-

Market Risk: Equity portion is subject to market volatility; returns are not guaranteed.

-

Interest Rate Risk: Debt portion may be impacted by changes in interest rates.

-

Expense Ratio: While competitive, always compare with other funds for cost efficiency.

-

AUM Size: Large AUM can sometimes make it harder for the fund to generate alpha, especially in mid- and small-cap segments.

How Does SBI Equity Hybrid Fund (MUTF_IN: SBI_EQUI_HYBR_VUWAZQ) Compare to Peers?

| Feature | SBI Equity Hybrid Fund | Peer Hybrid Fund (Example) |

|---|---|---|

| Equity Allocation | 65-75% | 65-75% |

| Debt Allocation | 20-30% | 20-30% |

| 5-Year Annualised Return | ~18% | 15-18% |

| Expense Ratio | 1.4% | 1.5-2% |

| AUM | ₹74,000+ Crore | ₹40,000-60,000 Crore |

| Consistency | High | Varies |

Conclusion

The SBI Equity Hybrid Fund (MUTF_IN: SBI_EQUI_HYBR_VUWAZQ) stands out as a balanced, reliable, and well-managed option for investors looking to benefit from both equity growth and debt stability. Its consistent track record, large-cap focus, and flexible investment options make it a strong contender for long-term wealth creation. However, as with all market-linked investments, it’s essential to align your investment horizon and risk appetite before investing. Always consult a financial advisor to ensure this fund fits your unique financial goals.

By understanding the nuances of the SBI Equity Hybrid Fund, you can make informed decisions and take a confident step towards your financial future.

Frequently Asked Questions (FAQs)

1. What is the ideal investment horizon for SBI Equity Hybrid Fund (MUTF_IN: SBI_EQUI_HYBR_VUWAZQ)?

The fund is best suited for investors with a minimum investment horizon of 5 years, as this allows the equity portion to ride out market volatility and the debt portion to provide stability.

2. How is the SBI Equity Hybrid Fund taxed?

Long-term capital gains (LTCG) above ₹1.25 lakh in a financial year are taxed at 12.5% if held for more than 1 year. Short-term gains are taxed at 20% if redeemed within 1 year.

3. Can I start an SIP in SBI Equity Hybrid Fund with a small amount?

Yes, you can start an SIP with as little as ₹100 per month, making it accessible for all types of investors.