If you’ve come across the code “mutf_in: sbi_cont_reg_us1q75,” you’re likely looking at the ticker symbol for the SBI Contra Fund Regular Growth plan, one of India’s most prominent mutual fund schemes. This article will serve as a complete, user-friendly guide to the SBI Contra Fund Regular Growth, covering its investment philosophy, performance, portfolio, suitability, tax implications, and frequently asked questions. Whether you are a new investor or looking to diversify your portfolio, this guide will help you make an informed decision.

What is “mutf_in: sbi_cont_reg_us1q75”?

“mutf_in: sbi_cont_reg_us1q75” is the unique identifier (ticker symbol) used on various financial platforms, such as Google Finance, to represent the SBI Contra Fund Regular Growth plan. This fund is managed by SBI Mutual Fund, one of India’s leading asset management companies.

SBI Contra Fund Regular Growth: An Overview

-

Fund Type: Open-ended equity mutual fund

-

Investment Strategy: Contrarian

-

Launch Date: May 9, 2005

-

Benchmark: Nifty 500 Value 50 Total Return Index

-

Risk Level: Very High

-

Minimum Investment: ₹5,000 (lump sum), ₹500 (SIP)

-

Expense Ratio: 1.54% (as of March 2025)

-

Assets Under Management (AUM): ₹39,589.67 crore (as of Feb 2025)

-

Exit Load: 1% if redeemed within 1 year

What is a Contra Fund?

A contra fund follows a contrarian investment strategy. This means the fund manager invests in stocks that are currently out of favor or undervalued by the market but have strong long-term fundamentals. The idea is to buy low and sell high, capitalizing on market cycles and sentiment shifts.

Key Features of Contra Funds:

-

Invest in neglected or underperforming sectors

-

Aim for long-term capital appreciation

-

Higher risk, but potential for higher returns

Investment Objective and Philosophy

The SBI Contra Fund aims to provide long-term capital appreciation by investing in a diversified portfolio of equity and equity-related securities, following a contrarian approach. This means the fund manager looks for opportunities where the broader market may be pessimistic, but the underlying fundamentals suggest future growth potential.

Portfolio Composition and Top Holdings

As of June 2025, the SBI Contra Fund Regular Growth maintains a diversified portfolio with a strong bias towards large-cap equities, but also includes mid-cap and select small-cap stocks.

Portfolio Breakdown:

| Asset Class | Allocation (%) |

|---|---|

| Domestic Equities | 74.65 |

| Large Cap Stocks | 43.3 |

| Mid Cap Stocks | 9.58 |

| T-Bills | 3.80 |

| NCD & Bonds | 1.25 |

| CP (Commercial Paper) | 1.34 |

| TREPS & Others | 15.89 |

Top 10 Holdings (June 2025):

-

HDFC Bank Ltd.

-

Reliance Industries Ltd.

-

Kotak Mahindra Bank Ltd.

-

ITC Limited

-

GAIL (India) Ltd.

-

Torrent Power Ltd.

-

Punjab National Bank

-

Dabur India Ltd.

-

Indus Towers Ltd.

-

ICICI Bank Ltd.

This diversified approach helps manage risk while seeking opportunities across sectors.

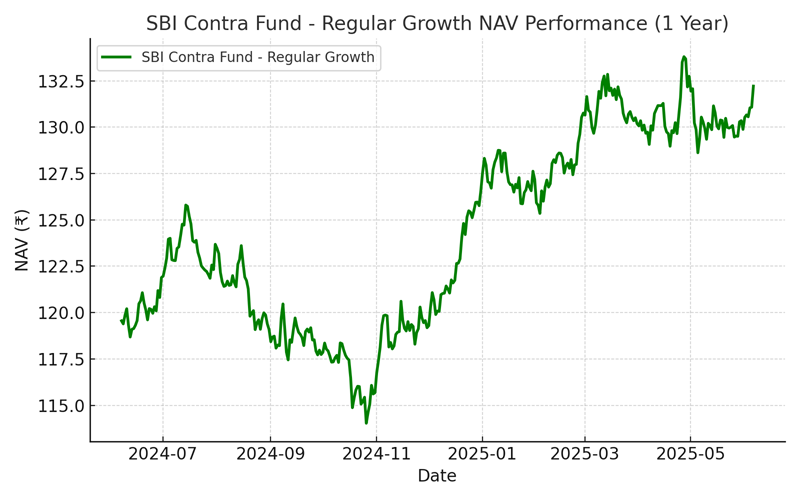

Performance Analysis

The SBI Contra Fund Regular Growth has delivered robust long-term returns, especially for investors who stay invested through market cycles.

Performance Snapshot (as of June 2025):

| Period | Absolute Returns | Annualised Returns | Category Avg | Rank in Category |

|---|---|---|---|---|

| 1 Year | 10.79% | 10.82% | 13.48% | 3/3 |

| 3 Years | 89.51% | 23.73% | 23.14% | 1/3 |

| 5 Years | 333.81% | 34.11% | 28.45% | 1/3 |

| 10 Years | 347.57% | 16.16% | 15.85% | 1/3 |

| Since Inception | 2196.20% | 16.88% | 14.87% | 1/3 |

SIP Performance:

A systematic investment plan (SIP) in this fund has also yielded attractive returns over the long term. For example, a ₹1,000 monthly SIP started 10 years ago would have grown to ₹3,39,231.12, an absolute return of 182.69% (annualized 19.72%).

Expense Ratio and Charges

The expense ratio of SBI Contra Fund Regular Growth is 1.54% for the regular plan, which is in line with the category average. The exit load is 1% if redeemed within one year, encouraging investors to stay invested for the long term.

Taxation

-

Long-Term Capital Gains (LTCG): If units are sold after one year, gains above ₹1 lakh attract 12.5% tax (excluding cess/surcharge).

-

Short-Term Capital Gains (STCG): If units are sold within one year, gains are taxed at 20% (excluding cess/surcharge).

Who Should Invest in SBI Contra Fund Regular Growth?

This fund is best suited for:

-

Investors with a high risk appetite

-

Those looking for long-term capital appreciation

-

Investors who can withstand short-term volatility

-

Individuals seeking diversification through a contrarian strategy

Due to its high-risk, high-reward nature, the fund is ideal for investors with a long-term investment horizon (at least 5 years).

How to Invest in SBI Contra Fund Regular Growth

You can invest in this fund through:

-

SBI Mutual Fund’s official website

-

Online investment platforms (Groww, Moneycontrol, etc.)

-

Registered mutual fund distributors and financial advisors

The minimum investment is ₹5,000 for a lump sum and ₹500 for SIPs.

Comparing SBI Contra Fund with Peers

| Fund Name | 1Y Returns | 3Y Returns | 5Y Returns | Expense Ratio | Risk Level |

|---|---|---|---|---|---|

| SBI Contra Fund Regular Growth | 10.79% | 23.73% | 34.11% | 1.54% | Very High |

| Invesco India Contra Fund Growth | 17.73% | 22.39% | N/A | N/A | Very High |

| Kotak India EQ Contra Fund Growth | 11.89% | 23.30% | N/A | N/A | Very High |

SBI Contra Fund stands out for its consistent long-term performance and large asset base, making it a preferred choice among contrarian funds.

Advantages of SBI Contra Fund Regular Growth

-

Proven track record of long-term outperformance

-

Diversified portfolio across sectors and market caps

-

Managed by experienced fund managers at SBI Mutual Fund

-

Suitable for SIP and lump sum investments

-

Contrarian strategy offers potential for superior returns in market cycles

Risks and Considerations

-

High volatility due to contrarian bets and equity exposure

-

May underperform during extended bull markets when favored sectors outperform

-

Requires patience and a long-term view to realize full potential

How to Track “mutf_in: sbi_cont_reg_us1q75”

You can track the performance, NAV, and portfolio of the SBI Contra Fund Regular Growth using the ticker “mutf_in: sbi_cont_reg_us1q75” on platforms like Google Finance, Moneycontrol, and the SBI Mutual Fund website.

Conclusion

The SBI Contra Fund Regular Growth (mutf_in: sbi_cont_reg_us1q75) is a compelling choice for investors seeking long-term growth through a contrarian investment approach. With a proven track record, experienced management, and a diversified portfolio, it offers the potential for superior returns, albeit with higher risk. Always consider your financial goals and risk appetite before investing, and consult a financial advisor if needed.

For those willing to ride out market cycles and invest with patience, the SBI Contra Fund Regular Growth can be a valuable addition to a diversified investment portfolio.

Frequently Asked Questions (FAQs)

1. What is the investment objective of SBI Contra Fund Regular Growth?

The fund aims to achieve long-term capital appreciation by investing in undervalued stocks using a contrarian investment strategy.

2. What is the minimum investment amount for SBI Contra Fund Regular Growth?

The minimum lump sum investment is ₹5,000, and the minimum SIP amount is ₹500.

3. What are the risks associated with investing in SBI Contra Fund Regular Growth?

Being an equity fund with a contrarian approach, it carries very high risk and is suitable only for investors with a long-term horizon and high risk tolerance.